The Hospital Inpatient Prospective Payment System proposed rule for federal fiscal year 2024 includes a change to the rural wage index calculation that has the industry buzzing because it would affect all hospitals – rural and non-rural alike.

If finalized, CMS will calculate each state’s RWI with data from rural hospitals and reclassified hospitals, even if those facilities are not rural geographically. As HealthLeaders notes, CMS’ approach since FFY 2020 has been to exclude reclassified hospitals from the rural floor calculation if they were not physically rural.

Why the change? Who stands to lose or gain? And what other changes should hospitals watch for?

What is the rural wage index?

With the FFY 2024 rule, CMS proposes to reverse its exclusion of hospitals redesignated as rural from the RWI calculation. DataGen Senior Healthcare Data and Policy Analyst Jacob Orsini notes that hospitals can reclassify if they are either near a rural area or have a patient population with enough rural residents in the mix.

CMS calculates RWI at the national level. Wage indexes at urban hospitals cannot be lower than those of rural hospitals, with the RWI used as a benchmark. This requirement is known as the rural floor and is subject to budget neutrality, meaning that increased payments due to increased rural floor values must be offset to keep Medicare spending equal.

The overall result of the proposed rule is the RWI will fluctuate significantly in states where there are many rural reclassifications, affecting all wage indexes nationally.

The impact of new RWI calculations

If CMS finalizes the new calculations, the RWI will increase significantly in multiple states, meaning:

- hospitals in states with RWI increases will see Medicare payment increases;

- hospitals in states where the RWI shrinks will receive lower payments; and

- the net nationwide effect will be neutral as required by CMS, affecting all hospitals paid using a wage index.

Hospitals will see changes to their inpatient Medicare payments effective Oct. 1, 2023.

While one regulatory expert[1] characterizes the changes as “how the pie is divided up,” the states and hospitals hit hardest are not likely to view the IPPS proposal that simply.

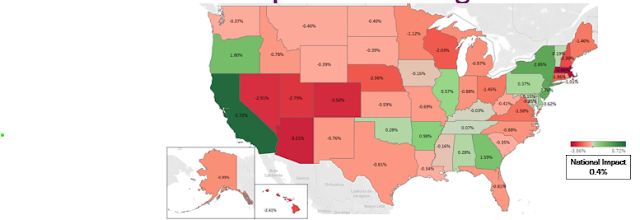

Projected impact of all WI changes

A total of 14 states could see higher payments driven by the proposed RWI policy (highest: California +6%). Most states (36) could see lower payments due to lower wage indexes. Decreases range from -0.03% (Kentucky) to -3.86% (Massachusetts).

Hospitals in states shown in red, however, have two saving graces: WI decreases cannot exceed 5% for any reason, and some proposed exclusions that would otherwise lower a state’s RWI may remain in place.

Why the change?

Why does CMS want to reverse an RWI calculation that has only been in place since FFY 2020? The courts.

In a press release for the proposed rule, CMS states that the changes come after “revisiting the statute and relevant court decisions.”

Federal rulemaking is a “lather, rinse, repeat” process. Agencies publish most rules as a draft (“proposed”) version, followed by a comment period. The final rule codifies the proposed rule with changes based on stakeholder input.

Other important IPPS changes

The RWI calculation is one of many IPPS proposed changes. Susan McDonough, DataGen’s vice president of advanced analytics, highlights three:

- Payment: CMS intends to update operating rates (+2.34% net) and capital rates (+4.5% net) for FFY 2024. McDonough notes that the 2.34% does not adequately reflect inflation. In addition, a Factor 3 change to the Disproportionate Share Hospital payment calculation will use three years of audited data and reduce utilization variability.

- More rural changes: The criteria for the low-volume rural hospital adjustment includes more stringent distance and discharge requirements in FFY 2025 and beyond.

- Quality: CMS proposed a change to the value-based payments scoring methodology to reward hospitals for excellent care in underserved populations with a health equity bonus.

The proposed IPPS rule changes are a lot to take in. DataGen can help you understand the implications, including their effect on outpatient payments, which use the same wage index as IPPS. Our regulatory rules analysis now includes IPPS analysis; the platform can also help you prepare comments for the upcoming Outpatient Prospective Payment rule.

Want to learn more? Contact us for a free consultation.

[1] Joe Krause (2023) Attorney with Hall, Render, Killian, Heath & Lyman, PC, as quoted in HealthLeaders.

Comments

Post a Comment